Violife follows the trend: global consumers reduce dairy consumption

- Adriana Motta

- Mar 25, 2025

- 5 min read

Violife followed the market demand and launched in 2024 their new product range: Supreme Coffee Creamers, a premium line of plant-based coffee creamers designed to deliver the rich, creamy texture and taste of traditional dairy creamers without animal ingredients.

The range features several varieties including Vanilla, Caramel, and Original, each formulated to blend seamlessly with hot beverages while adding distinctive flavor notes.

These creamers are presented in sleek, refrigerated cartons with pour spouts for convenient dispensing and contain no artificial preservatives, colors, or flavors.

Product innovation

The innovation behind is based on their coconut oil-based formulation enhanced with specific plant proteins that create a microemulsion mimicking dairy's molecular structure. This advanced emulsion technology prevents separation when added to hot coffee and replicates the mouthfeel of dairy cream without the chalky texture common in many plant-based alternatives.

"The product utilises a specialised fermentation process involving cultures similar to those used in traditional cheesemaking, applied to plant substrates. This process generates a flavour that closely resemble dairy notes while maintaining a completely plant-based composition. Their patented stabilisation system ensures consistent performance across temperature variations while maintaining clean label status."

- Flora Food US Inc

The ingredient list includes coconut oil, modified food starch derived from potato, culture-derived flavour enhancers, and natural flavour taste extracted from vanilla beans, caramel, and other natural sources depending on the variety. The formulation is free from common allergens including dairy, soy, nuts, and gluten, making it accessible to consumers with various dietary restrictions.

These creamers address several consumer needs in today's market. As plant-based diets continue to gain traction, these products provide an accessible entry point to plant-based alternatives that doesn't compromise the ritual and sensory experience of coffee consumption.

The product's competitive advantage stems from Violife's established credibility in the plant-based cheese category, where they've demonstrated expertise in replicating dairy textures and flavours.

Unlike many competing plant-based creamers, Violife Supreme offers an optimal balance of creaming performance, flavour enhancement, and visual appeal consumers expect from premium dairy creamers.

The product also addresses environmental concerns without explicit messaging, appealing to consumers seeking to reduce their environmental footprint through incremental dietary changes. With coffee consumption representing a daily habit for millions, switching to a plant-based creamer offers an accessible way to reduce dairy consumption without significant lifestyle changes.

The allergen-free formulation provides an additional competitive edge, catering to the growing segment of consumers with food sensitivities while maintaining broad appeal to mainstream coffee drinkers.

Development

The NPD emerged from extensive consumer research conducted by parent company Upfield. Their studies revealed a significant opportunity gap in the plant-based creamer category, as existing products lagged behind due to performance issues in hot beverages and flavour profiles that failed to complement rather than overpower coffee notes.

According to the company, based on Violife's established expertise in dairy-free products, the R&D team undertook an 18-month development process focused on creating a product that would meet or exceed performance in blind testing. This involved multiple exercises addressing texture, flavour release, heat stability, and shelf life considerations.

The process: The development team conducted sessions with professional baristas to understand the specific technical requirements for an ideal creamer performance across coffee varieties and preparation methods. Additional, consumer taste panels provided feedback on multiple formulations, with particular emphasis on recruiting traditional dairy consumers rather than committed vegans to ensure the product would appeal to mainstream audiences.

The brand positioning and packaging design were developed with premium coffee culture in mind, positioning the product as an enhancement to quality coffee rather than merely a dairy substitute.

Trends

Violife Supreme Coffee Creamers aligns with several significant market trends identified by major consumer research organisations:

According to Mintel's 2023 Plant-Based Dairy Alternatives report, the plant-based creamer segment grew by 27% in 2022-2023, outpacing the broader plant-based dairy alternative category which grew at 14%. Mintel further notes that 64% of consumers who try plant-based creamers cite taste and performance limitations as barriers to continued purchase, highlighting the opportunity for improved formulations.

____________________

North America: Plant based diary drinks, yogurt & ice cream launches, by share of sub-category, 2017 - 2022

Source: Mintel GNPD, March 2017-February 2022

____________________

Euromonitor International's 2023 "Health and Nutrition Survey" found that 42% of global consumers are actively reducing dairy consumption, with 27% specifically seeking plant-based alternatives for dairy products used in beverages. Their research also indicates that products positioned at the intersection of sustainability and premium experience command a 22% price premium on average compared to conventional alternatives.

____________________

Parent Market Overview of the Global Coffee Creamer Market

Source: Euromonitor International's 2023 Health and Nutrition Survey

____________________

NielsenIQ data from Q4 2023 shows that while overall coffee consumption remained stable, premium at-home coffee experiences grew by 18% year-over-year, driven by consumers seeking cafe-quality beverages in home environments. Their research indicates that 73% of coffee drinkers use some form of creamer or milk, with 31% expressing interest in plant-based options if they don't compromise the coffee experience.

Kantar Worldpanel's consumer panel data reveals that 58% of households now purchase at least one plant-based alternative product, with dairy alternatives representing the largest category. Their research shows that "gateway products" (everyday items that facilitate an easy switch to plant-based options) have the highest repeat purchase rates at 72%.

____________________

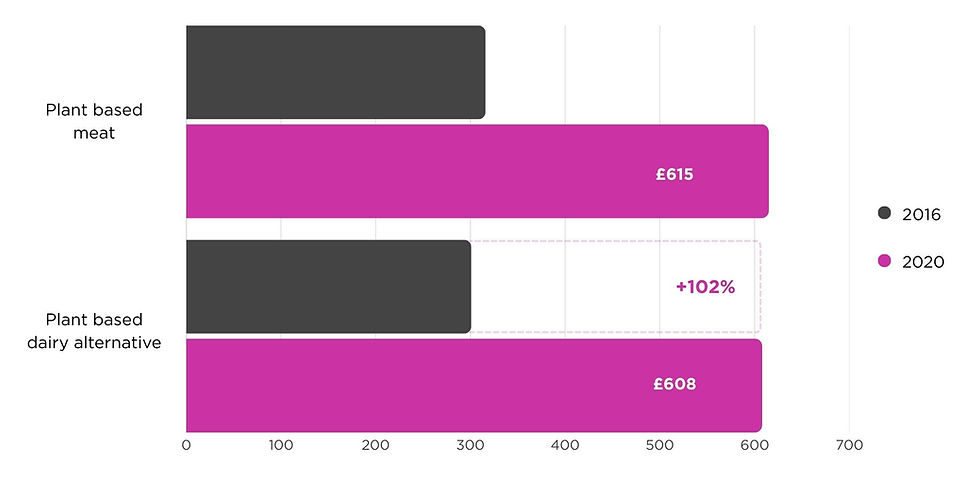

The UK plant-based market roughly doubled in value in the second half of the 2010s (£ million)

Source: Kantar, USDA analysis (original data reported in US dollars; converted to £ at 0.78). Please note, market data used throughout this report are not comparable due to difference in product categorisation.

____________________

The product also aligns with the "permissible indulgence" trend identified in FMCG Gurus' 2023 trend report, where consumers seek healthier options that don't compromise on sensory pleasure, with 67% of consumers agreeing that plant-based products should primarily deliver on taste and experience rather than emphasizing health claims.

Launch Details

Launched in the US in January 2024, targeting the world's largest coffee creamer market. The initial release covered major metropolitan areas including New York, Los Angeles, Chicago, and Seattle, with distribution through premium grocery chains including Whole Foods Market, Sprouts, and Wegmans, as well as select specialty coffee shops.

The product was priced at $5.49 for a 16 oz (473ml) carton, positioning it in the premium segment of the plant-based creamer category, comparable to other specialty creamers but at approximately a 15% premium to conventional dairy options.

Following the successful US launch, Violife announced plans for expanded distribution to additional North American markets in mid-2024, with European markets including the UK, Germany, and the Netherlands scheduled for Q3 2024. The international expansion maintained the premium positioning while adapting packaging and formats to align with regional coffee consumption habits.